The ETH/BTC exchange rate has recently hit a significant low, plummeting to 0.01791, its lowest point since 2020. This dramatic shift has caught the attention of investors worldwide.

As an investor, understanding the implications of this change is crucial. The current state of the ETH/BTC ratio may signal a significant shift in the cryptocurrency market. This could affect your investment strategies.

The recent decline in the ETH/BTC exchange rate raises important questions about the future of cryptocurrency investments.

Key Takeaways

- The ETH/BTC exchange rate has hit its lowest since 2020.

- This change may have significant implications for cryptocurrency investors.

- Understanding the current ETH/BTC ratio is crucial for making informed investment decisions.

- Investors should be prepared for potential shifts in the cryptocurrency market.

- The current state of the ETH/BTC ratio may influence future investment strategies.

The Current State of Ethereum’s BTC Ratio

The Ethereum to Bitcoin ratio has hit a multi-year low. This has raised concerns among investors about Ethereum’s performance. The ETH/BTC ratio shows how Ethereum compares to Bitcoin in value.

Understanding the ETH/BTC Ratio and Its Importance

The ETH/BTC ratio is key for traders and investors. It shows how Ethereum is doing compared to the whole market. If the ratio goes down, it means Ethereum is not doing as well as Bitcoin.

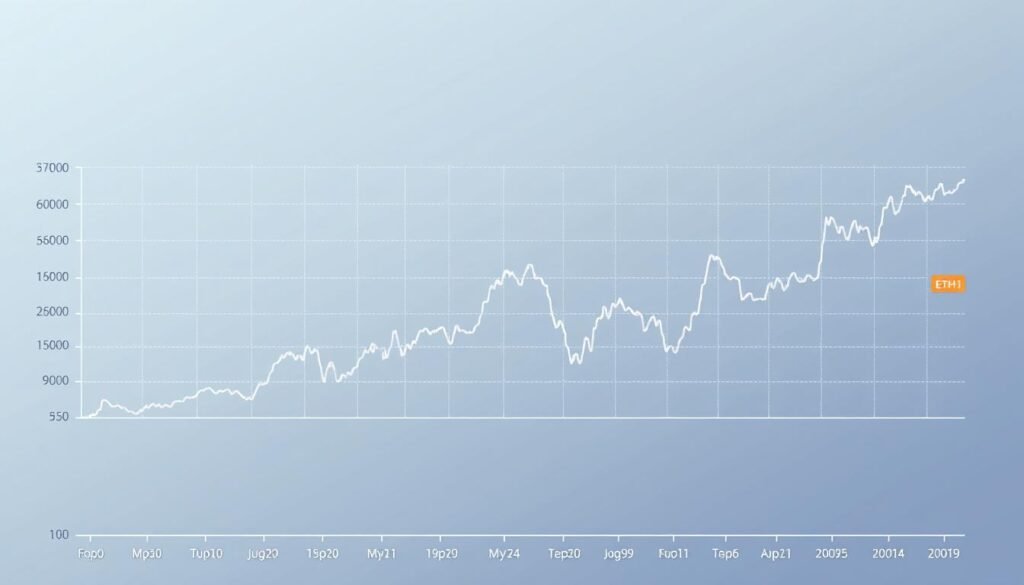

Recent Price Movement Data and Charts

Recently, the ETH/BTC ratio fell to 0.01791. This is bad news for Ethereum investors. It means Ethereum is losing value compared to Bitcoin, which could affect trading.

Historical Context: How Today Compares to 2020

Looking at the ETH/BTC ratio from 2020 gives us insight. The ratio has changed over time due to market and economic factors. Knowing these trends helps investors make better choices in the market.

Ethereum Plunges to Lowest BTC Ratio Since 2020: What Investors Should Know

The Ethereum to Bitcoin ratio has hit a new low. This change is big for investors. It’s important to know why this is happening.

Breaking Down the Significance of This Multi-Year Low

The recent drop in Ethereum’s BTC ratio shows a big change in the market. To understand this, we need to look at why it’s happening. A big part is how Ethereum is doing compared to Bitcoin.

Key factors to consider:

- Relative price movements between Ethereum and Bitcoin

- Changes in investor sentiment and market trends

- Development progress and updates in the Ethereum network

Key Metrics Behind the Plunge

Several things have led to Ethereum’s BTC ratio drop. Galaxy Digital moved 5,000 ETH to Binance on April 22, 2025. This move sparked talk of a big sell-off.

Timeline of Events Leading to This Market Shift

It’s important to know the timeline of events for Ethereum’s BTC ratio drop. Recent happenings include:

- Increased institutional adoption of Bitcoin

- Macroeconomic changes affecting crypto asset classes

- Development updates and network metrics for Ethereum

By looking at these factors and events, investors can better understand the market. This helps them make smart choices.

Technical and Fundamental Factors Driving the Ratio Decline

The drop in Ethereum’s BTC ratio is due to technical and fundamental factors. These are key for investors to grasp. Several important elements are influencing this change.

Ethereum Network Metrics and Development Progress

Ethereum’s network metrics and development are crucial for its value. For example, Ethereum’s staking ratio is currently at 28%. This is much lower than Solana’s 65% staking ratio. This difference can affect Ethereum’s appeal to investors.

Important metrics for evaluating Ethereum include:

- Transaction count and volume

- Number of active addresses

- Development activity around major updates

Bitcoin’s Institutional Adoption Advantage

Bitcoin is seen as more established and stable. This has drawn more institutional investors. As a result, Bitcoin’s market is influenced by these big investors. This can affect the BTC ratio.

| Cryptocurrency | Institutional Investment | Market Impact |

|---|---|---|

| Bitcoin | High | Strong |

| Ethereum | Moderate | Moderate |

| Other cryptocurrencies | Low | Low |

Macroeconomic Influences on Crypto Asset Classes

Interest Rate Impact on Technology Assets

Macroeconomic factors, like interest rates, greatly affect technology assets. Changes in interest rates can alter the appeal of different assets. This influences the market dynamics of Ethereum and Bitcoin.

Regulatory Developments Affecting Ethereum

Regulatory changes also impact Ethereum’s value compared to Bitcoin. As trading rules evolve, it’s vital for investors to know how these changes affect their investments.

Market Reactions and Expert Predictions

Ethereum’s BTC ratio has hit a low since 2020, sparking lots of talk in the crypto world. Understanding what different groups think and what experts predict can help you make smart choices.

Institutional Investor Position Changes

Institutional investors are watching the ETH/BTC ratio closely. They’re changing their strategies, with some choosing to hold more Bitcoin and less Ethereum.

This trend might keep going, affecting the ratio even more. Keep an eye on how these big players move, as their actions can shape the market.

Analyst Price Targets and Ratio Forecasts

Experts are updating their Ethereum price predictions because of the ratio drop. Some think Ethereum might bounce back, while others see it staying down compared to Bitcoin.

One key point is Ethereum’s RSI has risen to 57.26. This shows a big jump in short-term momentum. It’s something to think about when deciding where to invest.

On-Chain Data Insights and Whale Movements

On-chain data gives us a peek into Ethereum’s market situation. Big transactions by whales are being watched, as they might signal big changes in the market.

- Ethereum’s transaction volume has seen a moderate increase, indicating sustained interest.

- Whale movements suggest a potential accumulation phase, which could stabilize the price.

- Network congestion metrics have eased, reflecting improvements in scalability and usability.

Use these insights to guide your investment plans. Stay on top of market trends.

Strategic Investment Approaches for Different Investor Types

Ethereum’s value compared to Bitcoin is at its lowest since 2020. Investors must rethink their strategies. Knowing Ethereum’s current state is key for smart choices.

Short-Term Trading Strategies During Ratio Volatility

Traders aiming for quick profits see chances in the ETH/BTC ratio’s ups and downs. You can:

- Watch ratio trends and trade on expected changes.

- Use technical indicators for the best times to buy or sell.

- Keep up with news that could affect Ethereum’s price.

Long-Term Accumulation Considerations

Long-term investors might see a chance to buy low. Experts believe in Ethereum’s future because of DeFi and NFTs. To accumulate, consider:

- What you want to achieve and how much risk you can take.

- Ethereum’s growth potential compared to Bitcoin.

- Spreading your investments to lower risks.

Hedging Techniques for Ethereum Holders

Ethereum holders can use strategies to protect against losses. Options strategies are good for this.

Options Strategies for Protection

Options can shield your Ethereum from price drops. Buying puts or using collars can help. This way, you can lessen losses if Ethereum’s price falls.

Diversification Approaches Within Crypto

Diversifying is also smart. Spreading investments across different cryptos lowers risk. Think about adding to other promising projects.

Understanding Ethereum’s current situation is vital. Whether you trade short-term or invest long-term, knowing your options is crucial. Making smart choices is key to success.

Conclusion: Navigating Ethereum’s Future in a Bitcoin-Dominant Market

Ethereum has hit its lowest BTC ratio since 2020, leaving investors curious about their investments. Despite the current downturn, Ethereum remains the top choice for DeFi and NFT apps. This shows its strength against market ups and downs.

Think about how this low point affects your investment plans. The drop in Ethereum’s BTC ratio is a big deal that needs careful thought. Knowing what causes this drop is key to making smart choices.

Looking back to 2020, the crypto world has changed a lot. The current low BTC ratio brings both challenges and chances for investors. By keeping up with the market and adjusting, you can handle Ethereum’s future in a Bitcoin-led market.

Leave a Reply